Boost engagement and satisfaction with plug-and-play PFM tools—turn insights into real ROI.

Transactions Tracked

Transaction Accuracy

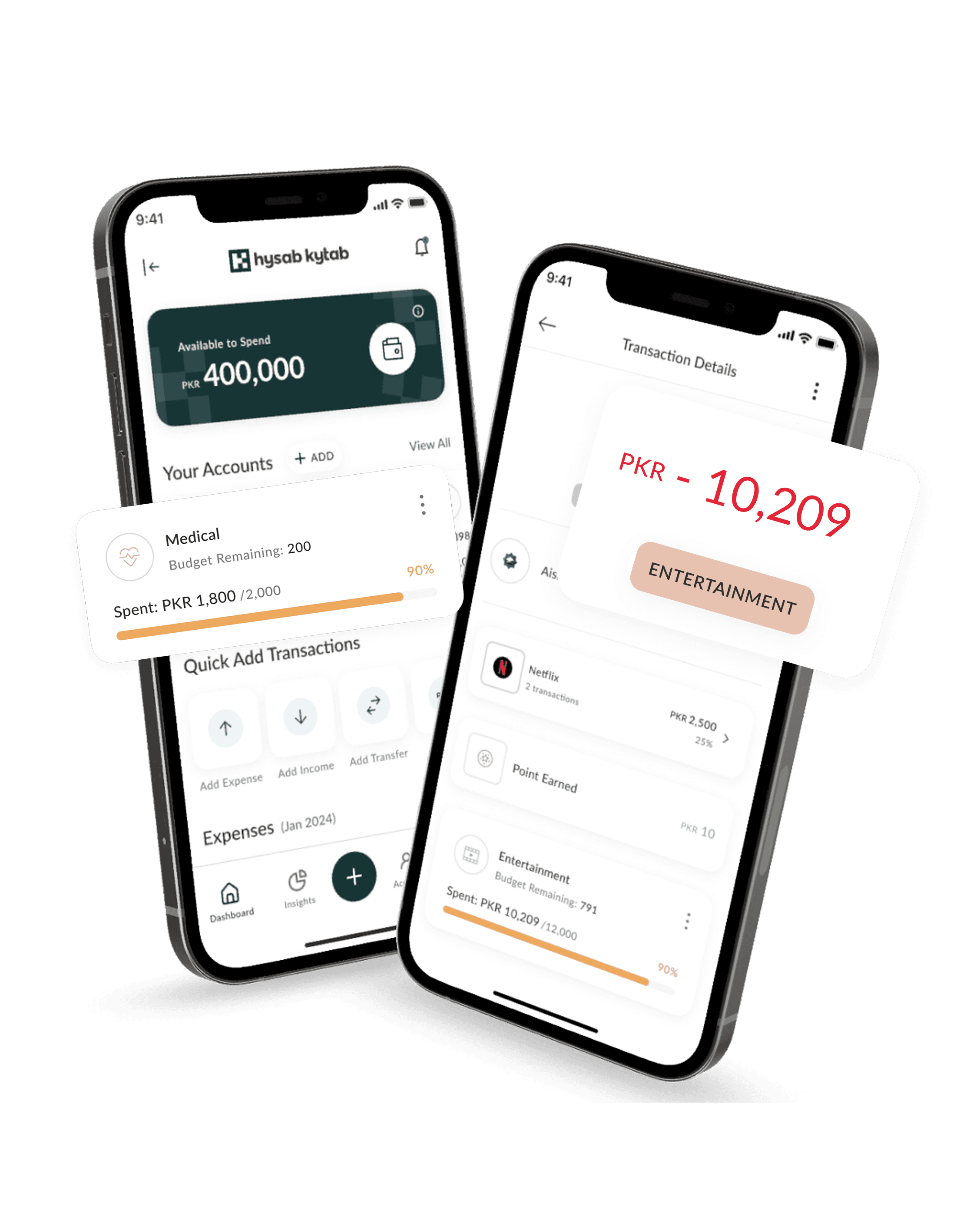

Help your customers understand their financial activities in seconds for smart savings and spending.

Amplify customer engagement and satisfaction with our plug-and-play PFM solution.

Bring clarity to every transaction to make personal finance a breeze for your customers.

Banking that builds lasting relationships.Foster trust, empower better money decisions, and make banking relevant and rewarding for every user.

AI-powered analytics help tailor offers, boosting product adoption and creating win-win situations.

Personalized insights and financial guidance that keep users coming back for more.

Users save more, budget better, and interact with your offerings more often.

Fast, scalable, and customizable to fit your bank’s needs.

Customers actively track spending, set budgets, and manage saving goals—all on your banking app.

Generic, one-size-fits-all banking experience with missed cross-sell opportunities.

Customers disengage due to a lack of meaningful insights and proactive support.

Limited motivation for customers to save or engage with banking services.

Lengthy, complex development for in-house solutions with rigid functionality.

Basic banking app with limited financial management tools, leading to lower engagement.

More product purchases

More time spent on app

Higher profit margins

Increase in app logins

...just in case you’re not convinced yet

Discover how Hysab Kytab can boost engagement, increase retention, and unlock deeper customer insights—all through a seamless, AI-enabled suite of solutions.