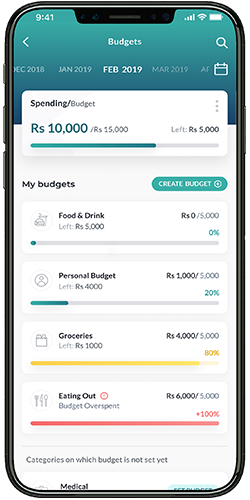

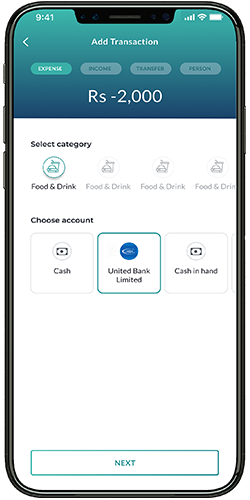

Open Banking and PFM?

Open banking and Personal Financial Management (PFM) solutions are two innovative concepts that have been revolutionizing the banking industry over the past few years. The concept of open banking refers to the sharing of user financial data between banks and…