Wedding Season

Wedding season is going around, and all those who are going to tie the knot is worrying about everything from the arrangement of the event to paying for each very piece of the wedding. But it is more important to take a step back and look around finance as weddings aren’t cheap and you have to decide how much you can spend and how you can save.

1. Sharing of financial situation

Before the celebrations of the big day, it is important that you share your financial situation with your partner. It can’t be really about only wedding finance but it should include about your debts, income, credits and any other financial issues because it’s better to find out ahead of time.

2. No vacations for finances

Be prepared about your financial plans, after getting married it is significant that you don’t have bills to be paid. Just sit around and discuss your needs as they come up in as much details according to your needs. Honeymoon is a great phase for the newly-weds but life still happens and finances comes around.

3. Discuss about finances

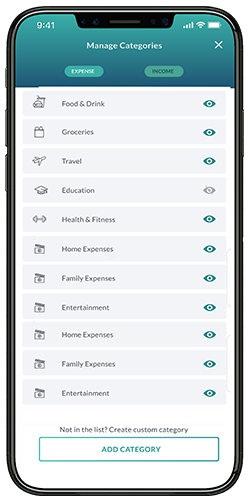

Conversation about finances can easily open the door for the couple to talk and have a discussion about your post wedding money matters. If you two are not regularly have a chat about finances than there will be a lot of trouble in money management. Find a good time in a week to have a conversation about your spending, budget and savings.

4. Partner views about finances

It is good to know your partner and their spending habits. There are number of things to consider likewise the amount of savings for both of you, and where you both going to invest your extra money. Spending money without planning will lead make you vulnerable it is necessary that you talk about how to use it.

5. Share the finances

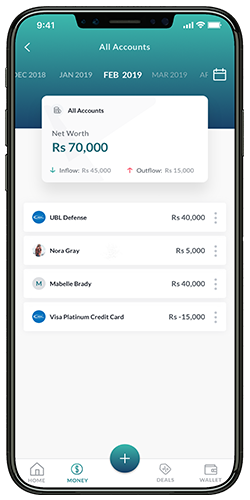

The simple act of sharing the financial task can make things easy both of you as family and economic issues occurs and affect the financial situation and once the problem arose it typically disrupt the balances. Keep an eye on what and where the money comes from and goes, decide what and how much to pay, divide household expenses and watch over any extra expenses.

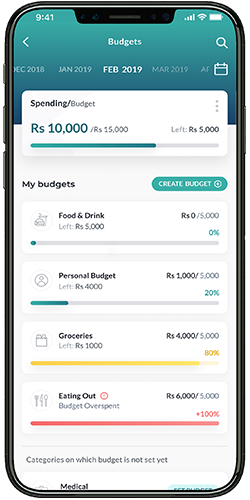

6. Budget

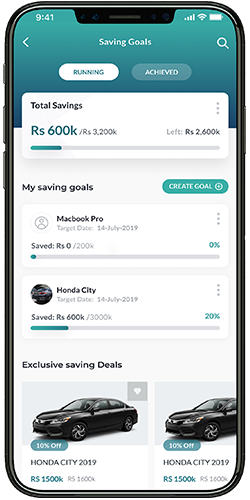

There will be a rapid change in monthly spending habits but the decision for savings like retirement, investment and setting up goals for the future does not change all that often. Be prepare and get hold on your finances don’t let them drift away in an inappropriate manner make a firm decision on budgeting and plan your future accordingly.

7. Be Satisfied

It is good to be satisfied with what you have and spend within the budgeted amount. Live and enjoy with the money you have don’t waste your happy moments on seeking more and more. if you are satisfied on what you have and live happily with it than the desire for unnecessary things will fade away.

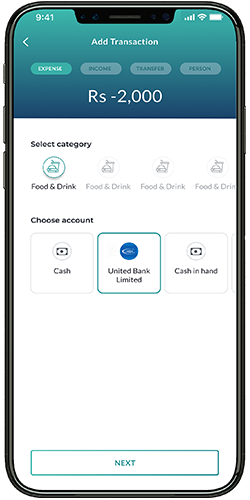

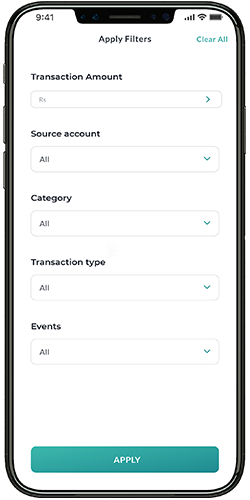

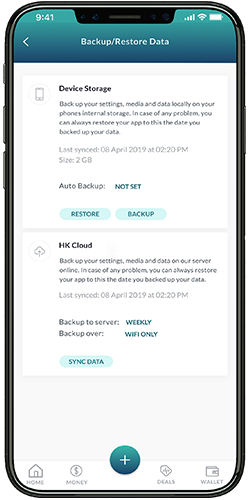

Hysab Kytab helps you to set up your budgets and goals in a smart way, it is a time tested solution which provides you just not only to set budget but also track your expenses in different category breakdowns and help you to identify in the exceeding of the budget. It also helps you to set up future goals and how much you can save to achieve that goal.

Well, you need any advices regarding the finances, want to have a fresh financial start along with your marriage. Don’t hesitate get the Hysab Kytab app now and set your finances on a right track.

By : admin

Tags: budget hysabkytab weddingfinance

08 Jan

Leave a Comments